In the realm of financial decision-making, where every dollar counts and the future is a gamble, net present value (NPV) emerges as a beacon of clarity.

Whether you’re sizing up a new project, weighing an investment, or steering a business venture, NPV offers a powerful lens to evaluate worth—not just in today’s terms, but by peering into the time value of money. It’s the art of boiling down streams of future cash flows into a single, present-day figure, revealing whether a pursuit will pay off or fall flat.

From seasoned analysts to curious beginners, net present value demystifies the art of smart business decision making, providing the key to seeing tomorrow’s profits through today’s eyes.

What is Net Present Value?

Net Present Value (NPV) is the current worth of an revenue and/or cost stream in today’s currency.

How to Use Net Present Value

It is used to make a decision to proceed with a business opportunity or project, for example:

- The construction of a new building

- Proceeding with a new business line

- Purchase of equipment

Net Present value takes into account the time value of money. It uses a discount rate to convert future payments into the equivalent present day payments.

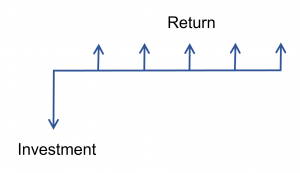

In a typical scenario, a large one-time expenditure is required to realize a longer income stream lasting several months or years. But many types of situations occur in business where there are multiple expenditures as well as revenues throughout a longer time period, and the present value of the whole cash flow scenario is an important metric.

- If the Net Present Value is greater than zero, accept the project.

- If the Net Present Value is less than zero, decline the project.

In order to convert a future payment to an equivalent present-day one, a discount rate must be chosen.

Discount Rate

The discount rate does more than predict future inflation. It must take into account opportunity costs, that is, the lost return on investment by not investing the money somewhere else more profitably. By not investing the money, the organization is foregoing future profits (or services, in the case of a non-profit or government).

The discount rate does more than predict future inflation. It must take into account opportunity costs, that is, the lost return on investment by not investing the money somewhere else more profitably. By not investing the money, the organization is foregoing future profits (or services, in the case of a non-profit or government).

The discount rate is used to calculate today’s value of a future income stream, but it can be compared to a target Internal Rate of Return (IRR).

Internal Rate of Return

The Net Present Value of an income stream can be back-calculated to produce the discount rate, or the rate of return on investment.

This can then be compared to rates of return on fixed income investments like bonds. If the return on investment is lower, the organization is better off to buy bonds.

Salvage Value

Most Net Present Value calculations require the use of a fixed term to account for the remaining value of the asset at the end of the analysis. For example, if you’re calculating the present value of the purchase of a piece of equipment, it is unlikely that the equipment will be used until it is completely dead. The organization will likely sell it while it can still operate. Thus, an estimate must be made as to when the equipment would be sold and how much it would sell for.

For extremely large expenditures like wind farms, oil refineries, etc., the present value calculation can be back-calculated to determine the payback period.

Payback Period

Alternatively, the payback period allows executives to get a stronger handle on a project’s risk level. It represents the amount of time before the expenditure is paid back. It is the point in time at which the expenditures equal the revenues, in today’s value.

Present Value in Program/Portfolio Management

From a program management perspective (i.e. management of multiple projects), Net Present Value should be determined for every project before a decision is made to pursue it. This ensures a comparison of apples to apples because of the sporadic nature of the cash flows.

Present Value in Project Management

From a project management perspective (i.e. within projects), the Net Present Value analysis is used to compare alternatives, for example the different types of equipment that could be purchased, what they would initially cost versus how much revenue they will generate.

A single payment

The Net Present Value, in today’s dollars, of one single future payment is:

P = (1 + i)-n

Where:

P = Value in today’s dollars

i = interest rate (%)

n = number of compounding periods

The common notation to express this calculation is P = (P/F, i%, n). For example, if I was trying to communicate that a project will receive a $1,000 income in 2 years time, with a discount of 8%, I would write (P/F, 8%, 2) = $961.17.

Multiple payments

If there is more than one payment, as inevitably all projects have, it’s the same calculation but many times over. There are two variations on this, the uniform series and the uniform gradient.

Uniform Series

P = (P/A, i%, n)

This is a series of payments of the same size and spacing. The notation is:

The Net Present Value calculation is:

Uniform Gradient

This is a series of payments that are changing at a uniform rate. The notation is:

P = (P/G, i%, n)

The Net Present Value calculation is:

Example

Let’s say we would like to purchase a robot for the assembly line of an phone accessory. We wish to invest $10,000 today, and we estimate the increased production to yield the following profits in years 1-5: $1,000, $2,000, $2,000, $5,000, and $2,000. The project represents a series of cash flows that looks like this:

| Year | Cash Inflows | Present Value (at 10% discount rate) |

|---|---|---|

| 1 | $1,000 | $909 |

| 2 | $2,000 | $1,653 |

| 3 | $2,000 | $1,503 |

| 4 | $5,000 | $3,415 |

| 5 | $2,000 | $1,242 |

| Present Value of cash inflows (Total) | $8,722 | |

| Less investment | $10,000 | |

| Net Present Value | ($1,278) | |

In this hypothetical example, each of the cash flows discounted to the present will not recover the initial investment, hence this investment should not be made.

Leave a Reply