Payback period is the length of time required for an investment to recover its capital. It is the amount of time required until the investment is in a break even position.

It is generally used for investments that involve a large up front capital outlay, such as the construction of an industrial facility or development of a software product.

The shorter the payback period, the more attractive the investment.

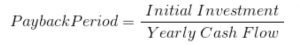

Formula

The Payback Period formula is simple.

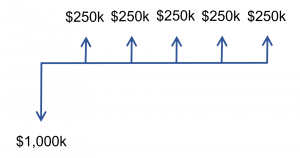

For example, if an initial investment of $1,000,000 generates $250,000 per year of revenue.

The payback period is $1,000,000 / $250,000 = 4 years.

Usage

The payback period is used to make investment decisions.

Organizations usually have a choice between many projects to undertake, each with their own advantages and disadvantages. When all other factors are similar, the payback period can be used as a decision making tool, since a fast payback period will rapidly flow into the business’ cash flow and balance sheet (financial health).

The payback period is an ideal metric for the relatively common scenario where a large upfront investment generates a steady return over time. Usually this return is accompanied by a considerable amount of project risk (if you build it, they will come… or will they?) hence a quick payback period will mitigate the market risk of making the investment.

Another common scenario is a lack of confidence in the quality of the revenue stream. For example, a solar power project is justified on the basis of a 20 year purchase contract, but what if the contract is not renewed? In this case, a fast payback period allows the project to break even prior to the adverse event, which makes the investment significantly more attractive.

Many examples abound of organizations that made a significant investment only to run into financial difficulty when the revenue stream was not as strong as expected. A short payback period limits the possibility of financial distress.

Advantages

- The payback period allows you to measure the attractiveness of an investment based on how quickly the initial investment breaks even. The other two main capital budgeting methods, net present value and internal rate of return, do not provide any consideration for this factor.

Disadvantages

- The payback period does not take into account what happens after the payback has occurred. As a result, any time when the revenue starts higher and then drops after the payback period has occurred (a common occurrence in business where products age, require higher maintenance, or sell fewer products), this metric would provide a skewed positive result.

Discounted Payback Period

Generally, the payback period does not take into account the time value of money. It is often used as a quick “back of the napkin” metric by investment professionals.

However, the capital expenditure and revenue stream can be discounted to include the time value of money, and this is what normally occurs within the feasibility study process prior to investment decisions for large industrial projects.

Feasibility Studies

The payback period is one of the most important metrics in the decision to proceed with large industrial projects.

These projects produce a feasibility study that provides a rough cost estimate (10 – 25% completion, depending on the project), a construction cost estimate, and an estimate of the future revenue stream.

The payback period is important for these types of projects because of the large expenditures involved. The corporation can assess the risk of various adverse events happening within that period.

Capital Budgeting Methods

Payback is one out of three main capital budgeting methods. The other two are:

- Net Present Value

The value of an investment’s income stream (positive and negative) in today’s currency. - Internal Rate of Return

The rate of return generated by an investment’s income stream.

Examples

Example 1

The payback period is:

- Payback Period = $10 million / $500,000/yr = 20 years

In this example, the project’s payback period is likely to be one of the owner’s most favored metrics (vs. NPV or IRR) because of the considerable risk undertaken by the company. This risk stems from the large, fully upfront expenditure. The quicker that all of the money is back in the bank, the less risky it is to the organization.

In addition, the investment decision can be made on the basis of the last 5 years of the payback period which is not covered by the guaranteed revenue stream.

Example 2

The payback period is:

- Payback Period = $20 million / $5 million/yr = 4 years

In this case, the resulting revenue stream is highly variable because of the volatility of the price of oil, hence it carries with it a significant amount of risk. This increases the importance of the payback period, that is, of getting the money back quickly.

Example 3

Even though the value of the deposit via other metrics (IRR, NPV, etc.) would be the same based on its size, the small, high grade core will be the first to be mined and put money in the bank quickly; It will serve to increase the payback period, thereby reducing investment risk, and potentially influencing the investment decision (or the value) relative to other, similarly sized deposits.

Example 4

The payback period will be of interest to executives because it shows how quickly the project can break even under various market demand scenarios.

Leave a Reply