Discounted cash flow is a project investment valuation method whereby future cash flows are discounted by a rate that accounts for the time value of money. It is used to make decisions between various available projects, or to determine the economic feasibility of a project.

For example, when a business is expecting revenue of $250,000 next year, the current value of that income (this year) is less than $250,000 because of:

- inflation

- opportunity cost.

Hence, the income is discounted.

It is usually used for projects which generate a future stream of income. The discounted cash flows are added together to determine the net present value of a project investment.

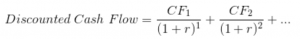

Formula

The formula for discounted cash flow is as follows:

Usage

Discounted cash flow is used to make decisions to proceed with a project, or to choose between several competing projects. It determines the present value, in today’s value, of all of the project’s expected cash flow.

- The decision to reject the project should be made when the discounted cash flow is less than the initial investment.

- When the discounted cash flow is greater than the initial investment, the project has a positive rate of return. If there is only one project being considered, it should be undertaken. But if there are multiple projects on the table, the net present value or internal rate of return is used to select the project with the greatest rate of return. Additionally, the payback period can be used to determine when the initial investment breaks even.

Time Value of Money

For a business, a dollar received today is not the same a dollar received tomorrow. The one received tomorrow is worth less. Why? There are several reasons:

- Inflation

The government is likely to increase the money supply within that time. - Opportunity cost

Less obvious to most people is that a business has the option to carry out other projects that have a better rate of return. They also have the ability to invest the money at a guaranteed rate of return (as a minimum, if your project generates less than 3%, the money should be invested in a guaranteed investment vehicle instead). Further yet, the business has the option of borrowing money at a known rate of interest and investing it in its operations which are currently generating a known rate of return. Usually this is significantly higher than the rate of inflation. In capital budgeting, the interest on borrowed money is averaged with the known rate of return on the business’ operations to become the Weighted Average Cost of Capital (WACC). This becomes the target rate of return for the business. Usually this is around 7 – 12%.

If a project does not generate a rate of return higher than the WACC it should be rejected, because the money is better spent elsewhere.

Examples

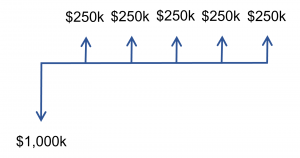

Example 1

A company wishes to build a new building. This building will cost $1 million and generate $250,000 per year in additional revenues for five years.

The discounted cash flow is the net present value of the positive cash flows (the return):

| Cash Flow | Discount Rate | Num Years | NPV |

|---|---|---|---|

| $250k | 4% | 1 | $240,385 |

| $250k | 4% | 2 | $231,139 |

| $250k | 4% | 3 | $222,249 |

| $250k | 4% | 4 | $213,701 |

| $250k | 4% | 5 | $205,482 |

| TOTAL | $1,112,956 | ||

As you can see, the investment is about half as profitable as a non-discount analysis might suggest.

Example 2

A food processing plant wishes to decide whether they should expand their existing plant or build a new one.

A food processing plant wishes to decide whether they should expand their existing plant or build a new one.

- Plant expansion will cost $30 million. The discounted cash flows will be $22.5 million.

- Building a new plant will cost $120 million. The discounted cash flows will be $55 million.

Based on the discounted cash flows, the decision is made to proceed with option 1, the plant expansion.

Example 3

A solar power firm has received a government power purchase agreement worth $20 million per year for 10 years, for the construction of a solar farm. They have narrowed down the options to three locations.

A solar power firm has received a government power purchase agreement worth $20 million per year for 10 years, for the construction of a solar farm. They have narrowed down the options to three locations.

- Close to the city, the discounted cash flow is $142 million and the cost to build the farm is $200 million.

- In the country, the discounted cash flow is $142 million and the cost to build the farm is $100 million.

- In between, the discounted cash flow is $142 million and the cost to build the farm is $150 million.

The site in the country is the most profitable, but the middle site is roughly break even.

Leave a Reply