The internal rate of return (IRR) of a project is the expected growth rate of a project investment. It can be compared to the rate of return obtained by investing the money in the stock market or in other projects. Organizations typically calculate IRR to make decisions between several investment alternatives.

It is the discount rate that results in a net present value of zero.

The higher the IRR, the more desirable the project is.

To make a proper investment decision, the IRR should be analyzed together with the other two capital budgeting methods:

- Net Present Value (NPV)

- Payback period

When the investment results are intangible, non-monetary returns, such as for road construction or environmental remediation projects, a cost-benefit analysis is more appropriate.

A typical project investment scenario involves a large investment followed by a steady stream of smaller returns, like this:

The internal rate of return is the return on investment that the project represents.

Formula

The IRR is normally calculated via iterative methods, since a direct calculation is quite difficult. The formula is:

Usage

The IRR is usually calculated in project feasibility studies or in planning studies for large projects. It is presented as one metric together with several others (net present value and payback period) each of which have their pros and cons, which provide a justification for the project and allow management to make the decision to proceed.

Corporate executives make decisions every day that involve how best to deploy the organization’s capital. Every year there is a little money left over (hopefully). This money can be deployed into the organization’s operations, producing a rate of return similar to the organization’s past rates of return (calculated from profit/loss statements) or invested into a capital project. The important question is whether the capital project produces a rate of return similar to or greater than reinvesting the funds into its operations. In some cases there are multiple, competing projects to choose from as well.

Corporate executives make decisions every day that involve how best to deploy the organization’s capital. Every year there is a little money left over (hopefully). This money can be deployed into the organization’s operations, producing a rate of return similar to the organization’s past rates of return (calculated from profit/loss statements) or invested into a capital project. The important question is whether the capital project produces a rate of return similar to or greater than reinvesting the funds into its operations. In some cases there are multiple, competing projects to choose from as well.

To further define this, it’s important to consider that every organization has a certain rate of return that its capital is achieving by being invested into its operations. This is called its cost of capital. The firm can also obtain money via debt financing, complicating the matter slightly. But if the firm has debt, the interest rate on the debt is averaged with the return of this reinvested capital to form the weighted average cost of capital (WACC).

The WACC becomes the minimum standard to justify new projects. That is, if the project cannot achieve the WACC, the money is better spent elsewhere within the business.

Finally, the IRR is the metric which is compared to the WACC.

- If IRR > WACC, the project should proceed.

- If IRR < WACC, the project should be rejected (or revised to increase IRR)

Advantages

- IRR provides a metric which can be compared to an organization’s cost of capital.

Disadvantages

- It doesn’t take into account the limited funds available. For example, if based solely on IRR, you might choose a small project with an IRR of 30% over a large project with an IRR of 25%. But then you might have the money to proceed with a third project with an IRR of 10%, lowering the total organizational return below 25%. Hence, it would be better to choose the project with an IRR of 25%.

- It assumes that all positive capital generated by the project will be reinvested at the project’s IRR rather than the corporation’s cost of capital.

Examples

Example 1

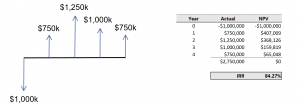

A company wishes to invest $1 million in a new production line. The anticipated cash flows are:

| Year | Return |

|---|---|

| 0 | -$1,000k |

| 1 | $750k |

| 2 | $1,250k |

| 3 | $1,000k |

| 4 | $750k |

What is the Internal Rate of Return (IRR)?

To solve this, an iterative method is used. The cash flows are set up in a spreadsheet and each cash flow item is discounted to form a standard net present value calculation. The discount rate is adjusted until the net present value is zero.

Example 2

A food processing plant wishes to expand its production. It commissions a preliminary engineering report which lists several options:

A food processing plant wishes to expand its production. It commissions a preliminary engineering report which lists several options:

- A new site nearby requires a land purchase and plant construction, and contains significant ongoing logistical costs due to transportation of parts and equipment between facilities. The project IRR is 27% and it would double the production.

- Expansion of the existing plant is cheaper, but there is a maximum capacity increase available. The project IRR is 54% and the production will double.

The company should choose option 2 because of the higher internal rate of return.

Example 3

An airline wishes to replace several aging airplanes. The cost of new airplanes is estimated as well as the expected revenue over its expected life span. The purchasing team calculates the net present value, payback period, and internal rate of return. They present a report to the management which includes an Internal Rate of Return (IRR) of 14%. The firm’s weighted average cost of capital (WACC) is 8.5%.

An airline wishes to replace several aging airplanes. The cost of new airplanes is estimated as well as the expected revenue over its expected life span. The purchasing team calculates the net present value, payback period, and internal rate of return. They present a report to the management which includes an Internal Rate of Return (IRR) of 14%. The firm’s weighted average cost of capital (WACC) is 8.5%.

The airline should make the decision to purchase the airplanes because the IRR of the investment is greater than the firm’s cost of capital.

Example 4

A real estate company wishes to build another condo. They estimate the cost of the lot, the construction materials, and labor. They also estimate the sale price of the units. The cash inflows and outflows are discounted and the internal rate of return is determined to be 4.7%. The firm’s cost of capital is 6.8%.

A real estate company wishes to build another condo. They estimate the cost of the lot, the construction materials, and labor. They also estimate the sale price of the units. The cash inflows and outflows are discounted and the internal rate of return is determined to be 4.7%. The firm’s cost of capital is 6.8%.

The company should find another project because the IRR is less than the firm’s cost of capital.

Leave a Reply